tariffs effects on metal fabricators Nationally, steel and aluminum tariffs resulted in at least 75,000 job losses in metal-using industries by the end of last year, according to an analysis by Lydia Cox, a Ph.D. . What is a septic tank distribution box, and how important is it? Learn about this critical component, its purpose, and how it functions in this guide.

0 · why are steel tariffs so high

1 · why are steel tariffs down

2 · why are steel tariffs bad

3 · steel tariffs impact on manufacturing

4 · steel tariffs for manufacturing

5 · steel tariff increases

6 · steel imports and tariffs

7 · steel and aluminum tariffs

Electrical wiring and connection design and execution are critical components of contemporary car power distribution systems. They link different parts of the car and act as channels for the transfer of energy.

Indeed, increased costs of inputs into production due to recent U.S. tariffs, including steel, is associated with lower growth in export sales for U.S. firms according to recent research by.

No. The tariffs Trump imposed on Chinese goods in 2018 had a net negative effect on manufacturing jobs as well overall U.S. employment. The Federal Reserve Board found . The tariff expansion is meant to protect against imports of steel and aluminum products like nails, tacks, as well as stamped car and tractor parts. And the impact of these tariffs really depends on where exactly metal . Section 232 tariffs, as well as waves of petitions for antidumping and countervailing duties over the last decade, have resulted in a far more protected U.S. flat-rolled steel market. . Nationally, steel and aluminum tariffs resulted in at least 75,000 job losses in metal-using industries by the end of last year, according to an analysis by Lydia Cox, a Ph.D. .

On March 23, 2018, U.S. President Donald Trump imposed 25 percent tariffs on the import of virtually all foreign steel. These tariffs were actually taxes on U.S. companies that import steel, and they cost such firms nearly . The Section 232 tariffs on imports of steel and aluminum raised the cost of production for manufacturers, reducing employment in those industries, raising prices for consumers, and hurting exports.

why are steel tariffs so high

1:04. President-elect Donald Trump has promised a "manufacturing renaissance" upon his return to the White House, pledging tariffs to bolster companies that make products within the United States . Recent tariffs changes proposed by President Joe Biden’s administration constitute one win and one loss for steel product fabricators who import steel from China. If Trump lifts tariffs to 60% or more, as much as 12.78 million tons of indirect steel exports will be at risk, threatening demand for the battered steel industry, Qi said.

It’s been a busy month on the trade and tariff fronts. The past several weeks have seen the U.S. and China sign a “Phase 1” deal to relax trade war tension; the Trump administration expand tariffs on steel and aluminum . Fabricators are suffering, as are other sectors affected by an ever-widening array of tariffs. And the effects are hitting some areas in ways that might not be top of mind. For example, . Job loss is a concern for metal fabricators. . The Aluminum Association applauded a plan announced by the Canadian government to impose a 25% tariff (or “surtax”) on certain aluminium and aluminium products imported from China.. Pending a public review and comment period, the tariffs are slated to be implemented by October 15. The move is consistent with long-time calls by the Aluminum . At the time Trump’s tariffs were imposed, the U.S. had 164 antidumping and countervailing duty orders in effect for steel that restricted imports of individual steel products from certain .

By understanding your unique situation, I can tailor my advice to help you mitigate the effects of tariffs, ensuring that your business remains competitive and profitable. . If you’re looking to optimize your production process or need expert advice on metal fabrication equipment, I’m here to help. Feel free to reach out to discuss your .

Uncertainty Increases As Tariffs Go Into Effect . March 29, 2018 . After months of speculation, the U.S. government recently implemented a 25 percent tariff on . and how things will shake out, but metal fabricators, such as MillerClapperton are in a vise at the moment. We are seeing across the board price increases from our suppliers and vendors,The Impact of Tariffs and Trade on Metal Fabrication Companies. When Donald Trump enacted tariffs of 25% on steel and 10% on aluminum last March, it sent shockwaves rippling through the manufacturing community. These tariffs then resulted in the affected countries placing tariffs on US-made goods. The US plans to impose 25pc tariffs on Chinese minerals including indium, tantalum, chromium, cobalt and tungsten, citing China's efforts to dominate global supply chains, according to the office of the US Trade Representative (USTR). . cobalt, and tungsten will go into effect on 27 September. Tariffs on natural graphite and permanent magnets .National economic numbers, such as the recent report that a trade war could adversely affect 11 million U.S. jobs, can be hard to fathom. That’s why it’s important to drill down to the company level to gauge the specific effect of fiscal policies. Metcam President Bruce Hagenau joined several other top manufacturer

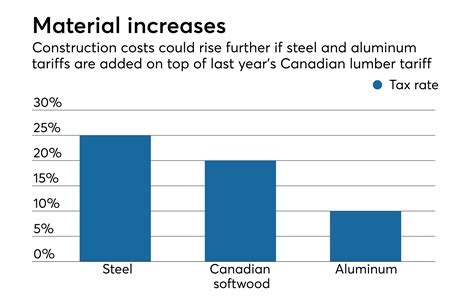

From APRIO by Sandi Buttram The industrial real estate sector is bracing for the impact of recent steel tariffs on two fronts. Industrial manufacturers could see their bottom line shifting as the cost of production increases. And industrial/distribution facility construction costs could rise with the price of raw materials. “Pricing has gone up significantly In the last 60 years, family-owned SteelFab has grown from a small maker of ornamental handrails in Charlotte, N.C., to a large metal fabricator. It buys steel from Glenn Sherrill’s company buys .

tariff on imports - Sheffield Metals is a leader in the distribution of coated and bare metal products, as well as engineered standing seam metal roof (SSMR) & wall systems.The metal fabrication & manufacturing industries may not face the massive ups & downs of other sectors, there are still trends set to influence them in 2019. . Tariffs and Trade in 2019. . but to what degree is still fairly unknown as the initial effects are still trickling down. For example, some fabricators were just beginning to feel the . While all manner of steel and aluminum product imports from China now face a new 25% tariff, Chinese-made metalworking machine tools, especially important to domestic metal fabricators, might not be subject to new tariffs. The U.S. Trade Representative (USTR), in announcing the new tariffs, which .Meeting All of Your Precision Metal Fabrication Needs. We use the high quality materials in metal processing. From the raw material to the finished components, KECAI is your One-Stop shop for metal applications. Select Now. Industries; About us. Our Company.

Metal fabrication companies who produce commodity goods might rely on steel made overseas which experience far greater supply chain disruption. 3. Tariffs and Trade Wars. If supply chain shortages weren’t difficult enough, .

Manufacturers have quietly voiced frustration with numerous U.S. International Trade Commission decisions to protect domestic metal producers. With the recent announcement about widespread tariffs on imported steel and .FABTECH 2019: Section 232 steel tariffs winners, losers in metal fabrication September 2, 2019 In March of 2018, President Donald Trump tweeted : “Our Steel and Aluminum industries (and many others) have been decimated by decades of unfair trade and bad policy with countries from around the world.

The new tariff policy went into effect the same day, July 10, according to the Associated Press. Mexico’s Millennium newspaper said on the 10th, U.S. President Joe Biden and Mexican President Lopez said in a joint statement released by the White House on the same day, Mexico has agreed to the U.S. side of the request for cross-border steel .As expected, China then enacted its own, retaliatory tariffs on U.S.-made products, due to take effect on June 1st. Tariffs affect many different areas of the U.S. economy, including automotive, agriculture, and electronics, not to mention steel and aluminum fabricators and manufacturers. Read more about the tariffs @ Thomasnet.com.

In the United States, tariffs are collected by Customs and Border Protection agents at 328 ports of entry across the country. The tariff rates range from passenger cars (2.5%) to golf shoes (6%). Tariffs can be lower for countries with which the United States has trade agreements.

Metal fabricators and metal component importers strongly oppose the existing China tariffs. Phase II Machine & Tool Inc. and Taurex Drill Bits LLC are just two of the 1,500 companies that have written to the U.S. Trade Representative (USTR) raising questions about the utility of the current China tariffs.

FABTECH plans to host two Leadership Exchange sessions focusing on tariffs' impact on the US steel industry. Ever since the imposed 25 percent tariff on imported steel and 10 percent tariff on aluminum were announced in early March, metal fabrication companies and associations alike voiced disapproval. And when the tariffs were expanded to Mexico and Canada in June via Section 232, the two allies responded with implementing their own steel and . Tariff hikes on other products, including semiconductor chips, are set to take effect over the next two years. People shop at a retail shoe store in Manhattan on January 05, 2024 in New York City .As a Regional Sales Executive at Mac-Tech, I’ve had the privilege of working with countless businesses to optimize their manufacturing processes.Recently, I’ve been focused on helping my clients take advantage of significant savings on press brakes before new tariffs come into play. These tariffs are set to increase prices, and I want to ensure that my customers can secure the .

Tariffs imposed by the Trump administration on imported metals likely would have broad effects on American companies, including many industries in the Attleboro area that fabricate metal products .

why are steel tariffs down

Sheet metal fabrication is the process of turning flat sheets of steel, aluminum, titanium or other metals into metal structures or products. This transformation is achieved through a series of techniques such as cutting, punching, .

tariffs effects on metal fabricators|steel tariffs impact on manufacturing