schedule k-1 box 19 distributions Schedule K-1 for partnerships reports distributions to the partners in box 19A. Since you have to report your share of the partnership income or loss for the tax year whether or not . From basic concepts to advanced techniques, this guide covers everything you need to know about sheet metal bending. Learn about the different bending methods, tools, and tips to achieve accurate and high-quality results.

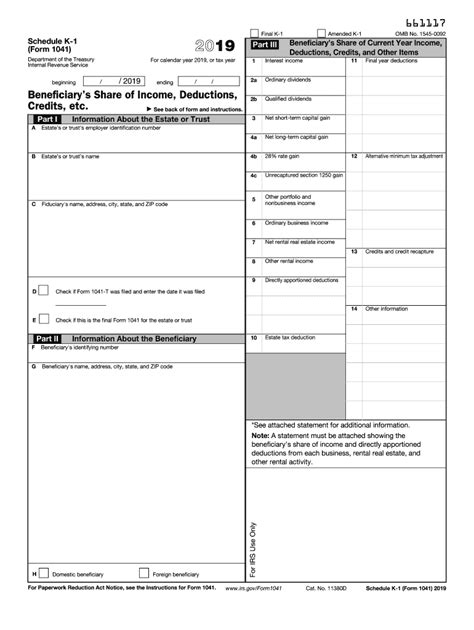

0 · schedule k1 form 1041

1 · schedule k 1 line 14

2 · schedule k 1 instructions

3 · schedule k 1 box 11

4 · schedule k 1 beneficiary instructions

5 · schedule k 1 14c

6 · k 1 box 14 instructions

7 · 14c schedule k1

Our general use electronic enclosures include sheet metal enclosures, chassis, hand-held enclosures, breadboards and more. See More. Use our selection tool to easily search thousands of Bud enclosures, racks and accessories, and find the perfect fit for your project.

Enter the property distributed subject to recognition of precontribution gain under section 737 as reported in box 19, code B, of Schedule K-1. Don’t include the amount of property distributions included in your taxable income.General Instructions. Purpose of Schedule K-1. The corporation uses Schedule K-1 .

Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. The distributions could have been cash or in other types of property. Think of a .The amount of loss and deduction you may claim on your tax return may be less than the amount reported on Schedule K-1. It is the partner's responsibility to consider and apply any applicable . Schedule K-1 for partnerships reports distributions to the partners in box 19A. Since you have to report your share of the partnership income or loss for the tax year whether or not .General Instructions. Purpose of Schedule K-1. The corporation uses Schedule K-1 to report your share of the corporation's income, deductions, credits, and other items. Keep it for your .

This article will help you enter a Schedule K-1 distribution for box 19, A on a partnership or fiduciary return. For more Schedule K-1 resources, check out our Tax topics .

Box 19. Distributions. Report any distributions you received in the form of cash, marketable securities, or property, or any distributions subject to section 737 here. Box 20. Other Information. Report any other information here using the .The Form 1065 Schedule K-1 shows two types of distributions on line 19. One distribution is shown in the amount of ,000 with the letter “A” in front of it. The second distribution is in the amount of ,000 and has the letter “C” in front of it.

Line 19A - Cash & Marketable Securities - The amount reported in Box 19, Code A is the cash and marketable securities distributed in kind to the taxpayer by the partnership. These items reduce the basis that the taxpayer has in the .

To enter gain on distributions: Complete the Computation of Section 737 Gain worksheet provided in the partner's instructions for Schedule K-1. The gain from the worksheet .

The Form 1065 Schedule K-1 shows two types of distributions on line 19. One distribution is shown in the amount of ,000 with the letter “A” in front of it. The second distribution is in the amount of ,000 and has the letter “C” in front .Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s New

The K-1 1065 Edit Screen in TaxSlayer Pro has an entry for each box on found on the Schedule K-1 (Form 1065) that the taxpayer received. A description of the Tax Exempt Income and Non-Deductible Expenses contained in Box 18, the .Schedule K-1 (Form 1065) Partner's Share of Income, Deductions, Credits, etc. (For Partner's Use Only) Department of the Treasury Internal Revenue Service Contents Page . Box 19. Distributions ...15 Box 20. Other Information ...16 List of Codes ...21 Section references are to the Internal Revenue Code .

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s NewBox 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s New

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s New Your partnership received a distribution from another partnership; the K-1 you provide your partners should only reflect the distributions they received from you. On your trial balance, those distributions from the other partnership should match the distributions you booked as a reduction of (credit to) "Investment in Other Partnership."Those distributions should be reported in box 19 of the K-1. They should also show up in Box L Partner's Capital Account Analysis on the line that says Withdrawals and distributions. . Line 19 of Schedule K is about distributions the partnership received. No it's not. Box 19. Distributions

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s New

Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. The distributions could have been cash or in other types of . the partnership will enter code B in box 19 of the contributing partner's Schedule K-1 and attach a statement that provides the information the partner needs to figure the recognized .Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s New

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s New Why doesn't the value I enter in box 19 on schedule K-1 affect the calculations in my Federal Tax return? I would expect a cash distribution from LLC should increase taxable income (i.e. capital gains).

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s NewK-1 Earnings; Schedule K-1 Form 1065; Credit and Other Information; This section of the program contains information for Part III of Schedule K-1 1065. Please be aware that the program does not allow for direct entries for all Box 14-20 information. You can review this article for any Box 20 codes that are not included in the Schedule K-1 entry. See separately the questions about "stock/stock options" versus your mention of a Form 1065 K-1. To report the long-term gain for a distribution in excess of basis (distribution up to your basis is not taxable), click the "magnifying glass Search" icon on the top row, enter "investment sales" in the search window and press return or enter, and then click on the .

Schedule K-1 doesn't show actual dividend distributions the corporation made to you. The corporation must report such amounts totaling or more for the calendar year on Form 1099-DIV, Dividends and Distributions. . Schedule K-1, box 19, will be checked when a statement is attached. . the gross income (code D) from, and deductions (code E . I attended your Manager Briefing – Clearing up K-1 Confusion (access the video here). I have a question regarding a recent K-1 I received. From the 1065 K-1: Item L Withdrawals and Distributions was ,000. On the same K-1, Box 19 A was ,500. There were no other codes listed in box 19 and full business tax returns were not provided.Schedule K-1 (Form 1120-S) and its instructions, such as legislation enacted after they were published, go to IRS.gov/Form1120S. General Instructions Purpose of Schedule K-1 The corporation uses Schedule K-1 to report your share of the corporation's income, deductions, credits, and other items. Keep it for your records. Don't file it with your tax

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s NewBox 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s New For instance, if your IRA-held investment rents out equipment, earnings from those rentals will be indicated in Box 3. As with Box 2, the debt-to-equity ratio will apply when calculating UBIT. Part III, Box 19 – Distributions. This describes any money disbursed to your retirement plan, which may not match the figure in Box 1.Box 19 of the K-1 (1065) records distributions made to you, the partner or member, during the year. The distributions could have been cash or in other types of . the partnership will enter code B in box 19 of the contributing partner's Schedule K-1 and attach a statement that provides the information the partner needs to figure the recognized .

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s New If there's a distribution in excess of basis, Lacerte doesn't automatically compute the gain. . Complete the Computation of Section 737 Gain worksheet provided in the partner's instructions for Schedule K-1. The gain from the worksheet must be entered in Screen 17.1, Dispositions. . Entering partnership Schedule K-1, Box 19B in ProConnect Tax.

Box 19. Distributions...25 Box 20. Other Information...26 List of Codes . Future Developments For the latest information about developments related to Schedule K-1 (Form 1065) and the Partner's Instructions for Schedule K-1 (Form 1065), such as legislation enacted after they were published, go to IRS.gov/Form1065. What’s New

schedule k1 form 1041

schedule k 1 line 14

UL 50 Electrical Enclosure Ratings Type 1 – Indoor Use. Provides basic protection against contact with the enclosed equipment and against falling dirt. A UL 508A panel shop is able to build an industrial control enclosure but is limited to rating the enclosure at .

schedule k-1 box 19 distributions|schedule k 1 box 11