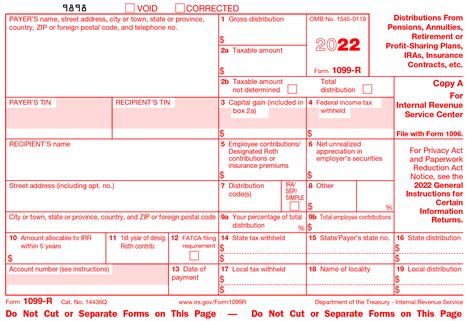

1099-t box 1 gross distribution must equal sample Information about Form 1099-R, Distributions From Pensions, Annuities, . This is a Cashbox made by the Union Steel Chest Corporation in Leroy, NY, USA. This company made these boxes from the mid 1930's thru the mid 1950's. It is Model No 1011, as stated on the tag. UNION CHESTS Buy Union & Be Right. The box is made of gray metal and there is a push-button that opens the top. The metal handle folds up and down.

0 · form 1099 r pdf

1 · 1099 r taxable amount

CANTEX PVC junction boxes connect effortlessly with our applicable PVC pipe and fittings. The CANTEX junction box can also be used with electrical metal tubing (EMT) as long as proper NEMA OS3 and NEC installation guidelines are followed along with all local codes.

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

Information about Form 1099-R, Distributions From Pensions, Annuities, . I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check .

A distribution that is part of a series of substantially equal periodic payments as described in section 72(q), (t), (u), or (v). A distribution that is a permissible withdrawal under . Since the 1099R reports a distribution to you of NUA shares, the sale of those shares was done outside the plan even if the plan required the sale back to the plan. That .

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a .Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the . 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is . Box 7 will contain a code classifying the type of distribution. (Examples include: 7 for normal distribution; B for Roth distribution; G for rollover to another account.) Form 1099-R .

The exemption from reporting payments made to corporations does not apply to payments for legal services. Therefore, you must report attorneys' fees (in box 1 of Form 1099-NEC) or .

Enter the total distribution (before income tax or other deductions were withheld) on Form 1040, 1040-SR, or 1040-NR, line 5a. This amount should be shown in box 1 of Form .If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7. I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check (,000). The amount reported in box 1, is the amount with the 20% tax I already paid (,250).

A distribution that is part of a series of substantially equal periodic payments as described in section 72(q), (t), (u), or (v). A distribution that is a permissible withdrawal under an eligible automatic contribution arrangement (EACA).

Since the 1099R reports a distribution to you of NUA shares, the sale of those shares was done outside the plan even if the plan required the sale back to the plan. That must be reported on a 1099B which you would then report on Form 8949 and Sch D resulting in LT cap gain tax on the amount of NUA. Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer. 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.

Box 7 will contain a code classifying the type of distribution. (Examples include: 7 for normal distribution; B for Roth distribution; G for rollover to another account.) Form 1099-R Box 1 lists the gross (total) distribution.The exemption from reporting payments made to corporations does not apply to payments for legal services. Therefore, you must report attorneys' fees (in box 1 of Form 1099-NEC) or gross proceeds (in box 10 of Form 1099-MISC), as described . Enter the total distribution (before income tax or other deductions were withheld) on Form 1040, 1040-SR, or 1040-NR, line 5a. This amount should be shown in box 1 of Form 1099-R. From this amount, subtract any contributions (usually shown in box 5 of Form 1099-R) that were taxable to you when made.

flameproof junction box manufacturers in india

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7. I received my 1099-R for making a 401k withdrawl from my former employer. The amount in box 1, however is not the amount I actually received when I got the check (,000). The amount reported in box 1, is the amount with the 20% tax I already paid (,250). A distribution that is part of a series of substantially equal periodic payments as described in section 72(q), (t), (u), or (v). A distribution that is a permissible withdrawal under an eligible automatic contribution arrangement (EACA). Since the 1099R reports a distribution to you of NUA shares, the sale of those shares was done outside the plan even if the plan required the sale back to the plan. That must be reported on a 1099B which you would then report on Form 8949 and Sch D resulting in LT cap gain tax on the amount of NUA.

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer. 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.

Box 7 will contain a code classifying the type of distribution. (Examples include: 7 for normal distribution; B for Roth distribution; G for rollover to another account.) Form 1099-R Box 1 lists the gross (total) distribution.The exemption from reporting payments made to corporations does not apply to payments for legal services. Therefore, you must report attorneys' fees (in box 1 of Form 1099-NEC) or gross proceeds (in box 10 of Form 1099-MISC), as described .

form 1099 r pdf

Page 1 of 3 JB1706 Underwater Junction Box HIGHLIGHTS • Designed for connection of supply cords from underwater fixtures and service conduits • Heavy wall cast bronze • Stainless steel hardware • Bottom and side entries avaialble • 32 cubic inches DIMENSIONS Specifications Length: 5-3/8" 137 mm Width: 5-3/8" 137 mm Height: 2-1/2" 64 mm ®

1099-t box 1 gross distribution must equal sample|form 1099 r pdf