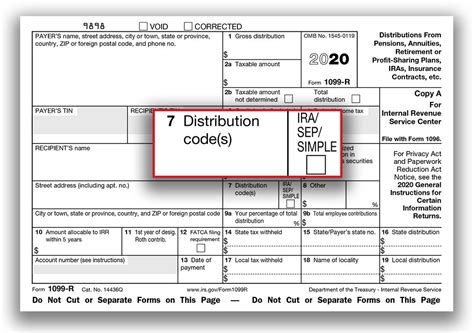

2018 form 1099-r distribution code 07 box 7 This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Form 1099-R must . Need surplus boxes for your distribution center and don't want to break the bank? Order your used boxes from Leader Box Corp. today!

0 · irs distribution code 7 meaning

1 · irs 1099 distribution codes

2 · irs 1099 box 7 codes

3 · distribution code 7 normal

4 · distribution code 7 non disability

5 · 7d distribution code 1099

6 · 1099 box 7 code m

7 · 1099 4 box 7 codes

The U-shape enclosure is very easy to customize, and can provide the right amount of through-panel access and other rack-mounting functionality options. We often build U-shape enclosures with custom cutouts, lengths, hardware, fasteners, and internal partitions.

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .We have added two new distribution codes, C and M, for box 7. New rollover code. We have added code "PO" for reporting qualified plan loan offset rollovers. In addition, see the 2018 .distribution. Report the amount on Form 1040 or 1040NR on the line for “IRAs, pensions, and annuities” (or the line for “Taxable amount”), and on Form 8606, as applicable. However, if this .

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Form 1099-R must .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R . One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code (s) to enter in Box 7, Distribution code (s) on IRS Form 1099-R, Distributions From Pensions, .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.We have added two new distribution codes, C and M, for box 7. New rollover code. We have added code "PO" for reporting qualified plan loan offset rollovers. In addition, see the 2018 General Instructions for Certain Information Returns for information on the following topics.distribution. Report the amount on Form 1040 or 1040NR on the line for “IRAs, pensions, and annuities” (or the line for “Taxable amount”), and on Form 8606, as applicable. However, if this is a lump-sum distribution, see Form 4972. If you haven’t reached minimum retirement age, report your disability payments on the line for “Wages, This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Form 1099-R must be sent no later than January 31 following the calendar year of the distribution. The image below highlights the 1099-R boxes most frequently used—and their .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

irs distribution code 7 meaning

One of the most difficult aspects of reporting IRA and QRP distributions is determining the proper distribution code (s) to enter in Box 7, Distribution code (s) on IRS Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

We have added two new distribution codes, C and M, for box 7. New rollover code. We have added code "PO" for reporting qualified plan loan offset rollovers. In addition, see the 2018 General Instructions for Certain Information Returns for information on the following topics.distribution. Report the amount on Form 1040 or 1040NR on the line for “IRAs, pensions, and annuities” (or the line for “Taxable amount”), and on Form 8606, as applicable. However, if this is a lump-sum distribution, see Form 4972. If you haven’t reached minimum retirement age, report your disability payments on the line for “Wages, This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Form 1099-R must be sent no later than January 31 following the calendar year of the distribution. The image below highlights the 1099-R boxes most frequently used—and their .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

irs 1099 distribution codes

best stainless steel cabinets for kitchen

best small shop cnc machine

irs 1099 box 7 codes

You can use a GFCI breaker if they're made for your panel. If it's it's not a kitchen or bathroom outlet, you can install a GFCI receptacle somewhere, and route the circuit via that point. If it is a kitchen or bathroom outlet, you can use a GFCI deadfront near the panel.

2018 form 1099-r distribution code 07 box 7|irs distribution code 7 meaning