what is 1099-r box 15 state distribution There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution. Search for used quad axle end dump. Find Peterbilt, Kenworth, Freightliner, Clement, GMC, Penta, Sterling, Volvo, and Western Star for sale on Machinio.

0 · utah state tax identification number

1 · internal revenue service 1099 r

2 · gross distribution on 1099 r

3 · georgia payer's state number

4 · federal tax form 1099 r

5 · 1099 r taxable amount

6 · 1099 r box 16 blank

7 · 1099 int state identification number

Whether you’re considering an abrasive waterjet with x-axis, y-axis, and z-axis motion control, seeking better pump pressure, or browsing our selection of affordable used waterjet machines for sale, we have the ideal solution to meet your needs.

There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT has highlighted, is greater than empty Box 15 titled State distribution. Additionally, the amount highlighted in Box 14 IS less than box 1 Gross distribution.There is NO box 12a on the 1099-R but Box 14 labelled state tax withheld, which TT .TurboTax is here to make the tax filing process as easy as possible. We're .Find TurboTax help articles, Community discussions with other TurboTax users, .

We would like to show you a description here but the site won’t allow us.If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution . If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State . A 1099-R tax form reports distributions from a retirement plan — income you might have to pay federal income tax on. But the form isn’t just for retirees drawing on their nest eggs. There are other situations when you might .

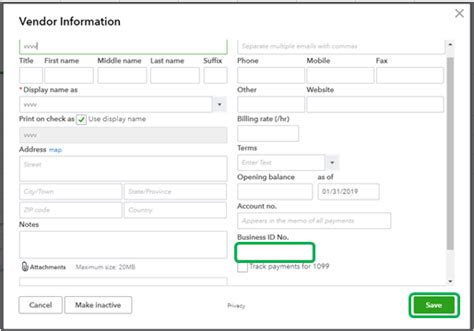

Expert Alumni. @Tpaoli70 1099-R box 14 is state tax withheld. Box 15 is the state and ID. Box 16 is the distribution amount. If you are a full year resident, you can use your box . You must file Form 1099-R with the IRS if you have given away or are treated as having made a distribution of or more from any of the following: Pensions. Annuities. Charitable gift annuities. Survivor income benefit plans. . Taxpayers and IRS examiners utilize the 1099-R to determine exactly what portions of distributions are taxable. These calculations help to arrive at the bottom line: How much is owed or how much gets refunded. .

A 1099-R is an IRS information form that reports potentially taxable distributions from certain types of accounts, many of which are retirement savings accounts. You’ll . In this article, we’ll walk through IRS Form 1099-R, including: A comprehensive look at what you should see in each box of this tax form; Distribution codes that may apply and how to understand them; Other .If you borrow money from a qualified plan, section 403(b) plan, or governmental section 457(b) plan, you may have to treat the loan as a distribution and include all or part of the amount .

You would enter the 1099-R with the total distribution in box 1 (the contribution plus the earnings), The earnings in box 2a, Enter code "P" in box 7 (Top) - don t worry that it will say "taxable in 2019 "Enter code "J" in box 7 (Bottom). On the "Which year" screen say that this is a 2021 1099-R. - That makes it taxable in 2020 and not 2019 @jdr41 If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16.. If Box 14 shows State Tax withheld, the Distribution Amount (Box 1) should be entered in Box 16.. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15 and 16 are blank.. Type '1099r' in the Search area, then click on 'Jump to 1099r' .Turbo Tax Home and Business 2020 is instructing the user to enter the State Distribution Amount in Box 16. However, the actual Federal Form 1099R Box gives this information in Box 14. In addition, Federal Form 1099R includes boxes 17 through 19. . Last year's boxes 12,13,14..are now "supposed" to be 14,15,16. Call whoever issued those 1099 . If you received worthless property, your employer may not file Form 1099-R. Box 2a: Taxable amount. In general, . The abbreviated name of the state and the payer’s state identification number should appear in Box 15. Box 16: State distribution. If applicable, this box contains the distribution amount subject to state taxes. Box 17: Local .

utah state tax identification number

This is because the 1099 for the DROP rollover has a different Distribution Code than the 1099 for the regular monthly pension benefit payments. . not the 1099-R recipient’s state of residence. Box 15 will say California whether or not the payee lives in California because it is SDCERS’ state/tax number. In the MD form box 19 says pick up contribution but the Turbo Tax form box 19 calls it local distribution. And on the next page Turbo Tax asks about pick up contribution but mentions it to be part of box 17. But the form 1099 sent . Yes, leave box 6 blank, however you will need to enter the NY amount and State ID (not TIN) in the state boxes in your Form 1099-R. Also enter the distribution in box 16, if after reviewing the information it doesn't fit the criteria for tax free treatment. Depending on the type of distribution it may be considered taxable for NY. If box 2a is empty, you probably need to put in the federally-taxable amount of box 1 into box 14. if you know that it is all taxable, then box 1 will do _____ For my state (NC), when I go thru the 1099-R entries, I leave box 14 empty.but when I step thru the questions following the main page, the software back-fills the box 14 software form .

State distribution box is blank on 1099-R, line 14. state withholding shows an amount in Box 12. should I enter the gross distribution from box 1? Box 2a is empty? . If state or local income tax has been withheld on this distribution, you may enter it in boxes 12 and 15, as appropriate. In box 13, enter the abbreviated name of the state and .

That would not be a 1099-R..that would be a CSF or CSA-1099-R that is issued by the Federal Office of Personnel Management (OPM) _____ 1) A standard 1099-R has State "withholding" in box 14 and total state distribution in box 16. 2) A CSF- or CSA-1099-R from OPM has State "withholding" in box 12 and total state distribution in box 14.

(PayInfo can only display ONE Form 1099-R.) The retirement allowance paid up until the month before you turned age 59 ½ will be reported on one Form 1099-R using distribution code 2, and the retirement allowance paid for the remainder of the year will be reported on a second Form 1099-R using distribution code 7. However, the instructions do not mention anything regarding the State distribution amount (box 16). Should box 16 kept blank or should I use the amount in box 1 (Gross distribution amount) and mention it in box 16? My state is California and I did not withhold any Federal or State taxes upon removal of excess ROTH contribution. Thanks.

On my Form 1099-R i have information entered in Box 15, however i cannot complete my taxes because it say that amount enter in box 15 cannot be greater than the gross distribution and it not. Also on my Form 1099-R box 15 says State taxable amount and on here it say Local withheld tax State withholding goes in box 14. State ID and ID number in box 15. State distribution in box 16 ...(IF no state distribution shows on your 1099-R form, some states require you to put the value of box 2a into box 16 in the software ...or the federally taxable amount of box 1 if box 2a is empty)

Hi, I have a retired client who was a public safety employee in Arizona (he was a firefighter). His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement income was not taxable at state.

The box 13 state ID is only necessary if there was state tax withheld in box 12. If box 12 is blank or zero then all boxes 12-14 must be blank. If there IS a dollar amount in box 12 then contact the issuer of the 1099-R for a corrected form that has the required box 13 information.

So, I have a 1099-R with Indiana listed in Box 15, but state tax withheld and and state distribution are blank. The "Recipient" is my name with the name and Indiana PO Box of the IRA custodian. I called Indiana DOR and was told that Indiana would be expecting a return and that I should get a corrected 1099 R from the pension plan. If your payer has one for your state and they have withheld any state income tax, it would be listed in box 13 on the 1099-R. If there is nothing listed in the State Payer number box (box 13), you can input NA (not available) in that box in the TurboTax software. If you have state income taxes withheld by the issuer and there is an amount in . Box 16 is the state amount of the distribution. In most cases it is the same as Box 1 - gross distribution. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. Enter the following in Box 16: If Box 14 shows State Tax withheld, enter the amount in Box 1 (gross distribution);

But I was recently issued my 1099-R's from these administrators and although my address on the form is in Florida, the local state distribution lists Indiana. . I'm not sure why the state box would be on the 1099-R form in the first place. . I think you'd referring to box 14. I'm mostly worried that there is an amount in box 16 after . The best thing to do would be to prepare a substitute Form 1099-R and enter everything the way it should have been reported, with the distribution in box 1, taxable amount in box 2(a), code in box 7, Michigan in box 15 and the Michigan tax withheld in box 14, any other information that should be on the form as follows:

The state distribution amount is the same as box 2a on the 1099-R form. IF box 2a is blank, or unknown, then it is the eventual Federally taxable amount that belongs in box 2a. IF you made no after tax contributions to that Govt pension, then all of box 1 belongs in box 2a, and all of box 1 belongs in the state distribution line. The software just tells you there is a 10% penalty.and one is calculated on your tax return. The withholding already done, and that you entered in box 4 of the 1099-R form, will be applied as a credit against that penalty, and any other taxes you may owe for the early withdrawal,, or even any other taxes you may owe too.An unofficial, casual place for State of California Workers, Union Members, Prospective Employees, and other people interested in State employment to discuss news, events and other items. . 1099-R Distribution Taxable? upvotes . 1099-R box 2a for annuity upvote . I think you have some labeling errors in the 1099-R form, specifically, the "verify entry" page. On the first page of 1099-R, Box 12 is about FATCA Box 13 is not there. Box 14 is State Tax Withheld (first state) Box 15 is the state and Number Box 16 is State Distribution Amount. All these labels an.

NOTE: prior to 2020 the state tax was in boxes 12-14, 2020 renumbered those boxes to 14-16. Box 16 is not usually required because it has been an 1099-R industrial standard for many years that if there is only one state in box 14 & 15 then the box 1 amount does not need to be allocated between two states - the entire box 1 amount is understood to be the state .

Box 16 on Form 1099-R is where the state income distribution is reported. It is possible if you leave that entry blank when you prepare your state tax return the distribution won't appear as taxable on it. . In box 15, enter the abbreviated name of the state and the payer's state identification number. The state number is the payer's .

receptacle metal box

internal revenue service 1099 r

Shop NASCAR merchandise, diecasts, and racing apparel from the Hendrick Motorsports team.Race Used Sheet Metal. Subcategories . NASCAR RACE USED #43 John Andretti 1998 AUTOGRAPHED STP Hood $ 2,000.00. Add to cart. NASCAR RACE USED #43 Bubba .

what is 1099-r box 15 state distribution|1099 int state identification number