box 7 of 1099 r for roth ira early distribution File Form 1099-R for each person to whom you have made a designated distribution . The range of distinct antique tobacco boxes — often made from metal, gold and silver — can elevate any home. Antique tobacco boxes have been made for many years, and versions that date back to the 18th Century alongside those produced as recently as the 20th Century.

0 · irs roth distribution instructions

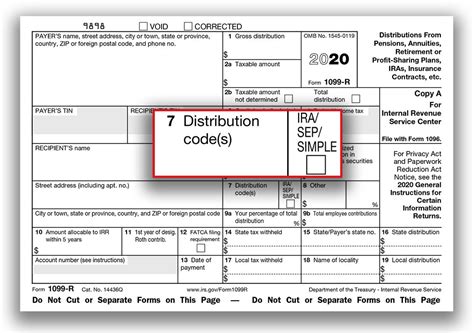

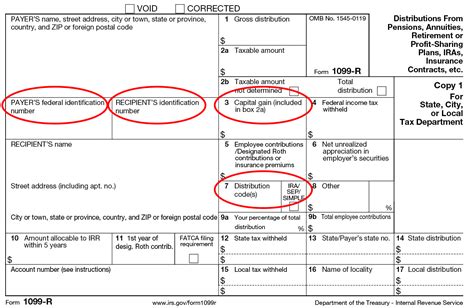

1 · irs form 1099 r distribution

2 · irs 1099 r box 7

3 · form 1099 r box 7 disability

4 · box 7 1099 r meaning

5 · 1099 r ira distribution code

6 · 1099 r box 7 examples

7 · 1099 r box 7 distribution

$75.00

irs roth distribution instructions

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).File Form 1099-R for each person to whom you have made a designated distribution .

However, you don't have to file Form 5329 if your Form 1099-R, Distributions From .

how to bond fiberglass to sheet metal

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Use Code J, Early distribution from a Roth IRA, to report a Roth IRA distribution when the IRA owner is under age 59½ and codes Q and T do not apply. But use code 2 for an IRS levy and code 5 for a prohibited transaction.Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Direct rollover of a .

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth . For participants born before a certain date, or their beneficiaries to indicate the distribution may be eligible for the 10-year tax option method of computing the tax on lump .

If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no . Use Code J, Early distribution from a Roth IRA, to report a Roth IRA distribution when the IRA owner is under age 59½ and codes Q and T do not apply. But use code 2 for an IRS levy and code 5 for a prohibited transaction.Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax.

However, you don't have to file Form 5329 if your Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. shows distribution code 1 in Box 7.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Direct rollover of a designated Roth account distribution to a Roth IRA. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 .

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for . For participants born before a certain date, or their beneficiaries to indicate the distribution may be eligible for the 10-year tax option method of computing the tax on lump-sum distributions (on Form 4972, Tax on Lump-Sum Distributions).If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross distribution and the appropriate code in box 7 (Code J for a Roth IRA).The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. 1 – Early distribution (except Roth), no .

Use Code J, Early distribution from a Roth IRA, to report a Roth IRA distribution when the IRA owner is under age 59½ and codes Q and T do not apply. But use code 2 for an IRS levy and code 5 for a prohibited transaction.Beginning January 1, 2024, the automatic rollover amount has increased from ,000 to ,000. See Automatic rollovers, later. Certain corrective distributions not subject to 10% early distribution tax. However, you don't have to file Form 5329 if your Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc. shows distribution code 1 in Box 7.

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Direct rollover of a designated Roth account distribution to a Roth IRA. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 .Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

how to bend 16 gauge sheet metal

$13.99

box 7 of 1099 r for roth ira early distribution|irs roth distribution instructions