state distribution on 1099-r box 16 Find TurboTax help articles, Community discussions with other TurboTax users, . At SWACable.net, we stock and supply a large range of SWA Cable junction boxes and glands, so if you cannot find the specific part or accessory that you require, please feel free to contact our Sales Team on 01244 288138 for further advice and information.

0 · is a 1099 r taxable

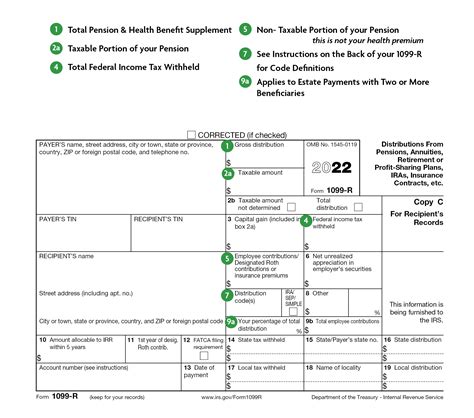

1 · irs 1099 r distribution codes

2 · irs 1099 r 2023

3 · internal revenue service 1099 r

4 · gross distribution on 1099 r

5 · 1099 r form pdf

6 · 1099 r boxes explained

7 · 1099 r box 16 blank

Browse 353 FLORIDA SHEET METAL jobs from companies (hiring now) with openings. Find job postings near you and 1-click apply to your next opportunity!

If your Form 1099-R does not have an amount in box 16 for a state distribution, but there is an amount in box 14 for state tax withheld, then the review message thinks there should be something in box 16.If your Form 1099-R does not have an amount in box 16 for a state distribution, .TurboTax is here to make the tax filing process as easy as possible. We're .

Find TurboTax help articles, Community discussions with other TurboTax users, .

We would like to show you a description here but the site won’t allow us. If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State .

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution .

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is . The abbreviated name of the state and the payer’s state identification number should appear in Box 15. Box 16: State distribution. If applicable, this box contains the distribution amount subject to state taxes. IRS Form 1099-R tracks the distributions from retirement accounts. Not only is this information necessary for the IRS to confirm tax liability, but it also provides needed information to state revenue collectors. Video of the Day. .

His 1099-R shows a taxable distribution in box 1 and 2 for fed taxes. However, box 16 (state distribution) does not show an amount. Does that mean this pension/retirement .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. . To enter a distribution reported on Form 1099-R in TaxSlayer Pro, from the Main Menu of the tax return (Form 1040) select: Income Menu; IRA, Pension Distributions (1099R, RRB-1099-R) New. If prompted, indicate .

If the 1099-R shows state taxes withheld in box 14, then use the gross distribution from box 1 and enter that number in box 16. February 27, 2022 11:05 AM 0 The state number is the payer's identification number assigned by the individual state. In box 16, enter the name of the locality. In boxes 14 and 17, you may enter the amount of the state or local distribution. . State distribution box is blank on 1099-R, line 14. state withholding shows an amount in Box 12. should I enter the gross . If there is an entry in Boxes 14 or 15 on your 1099-R, TurboTax will expect an amount in Box 16. If Box 14 shows State Tax withheld, you can enter the amount from Box 2a. If no state tax was withheld, you can delete the State ID number, so that Boxes 14, 15, and 16 are blank. See this article for more information on Form 1099-R.

Please try entering something in box 16 and then deleting the entry again and see if you can continue. If this doesn't work try to enter State withholding goes in box 14. State ID and ID number in box 15. State distribution in box 16 ...(IF no state distribution shows on your 1099-R form, some states require you to put the value of box 2a into box 16 in the software ...or the federally taxable amount of box 1 if box 2a is empty) for box 16 state distribution. Login to your TurboTax Account ; Click on "Search" on the top right and type “1099-R” Click on “Jump to 1099-R” and enter your first Form 1099-R Box 16 on Form 1099-R is where the state income distribution is reported. It is possible if you leave that entry blank when you prepare your state tax return the distribution won't appear as taxable on it. You can look at your state tax summary to determine if the proper income is being reflected on it by following these steps in TurboTax:

Since state taxes were withheld, something needs to be entered in all three state boxes. If your Form 1099-R does not show a state ID number, enter the Federal ID number. If your Form 1099-R does not show a state distribution (box 16), enter the distribution amount shown in box 1. @jpprod416 1099-R Box 14a for efiling New York State withholdings can not be greater than or equal to gross distribution or state distribution (nothing in box 16 on my form). . If your 1099-R has a state withholding in Box 14, you must enter Line 15 and 16 as well. If your 1099-R does not have a state payer number, it is possible that they do not have one. I have been doing backdoor roth conversion for several years. in my 1099-R forms 2021 and 2022 box 7 always showed code 2 (for roth conversion). However there is a difference between 2022 form and the previous years. Box 16 (state distribution) in 2021 and 2020 showed blank. Box 16 in 2022 form showed the full contribution amount (k for age 50+). The state distribution on the 1099-R is posted to box 16. If the state indicated is Ohio, it means that that portion of the distribution is taxable in Ohio. This is very often the state you live in. If you disagree with that, the first place to start is with the plan administrator.

NOTE: prior to 2020 the state tax was in boxes 12-14, 2020 renumbered those boxes to 14-16. Box 16 is not usually required because it has been an 1099-R industrial standard for many years that if there is only one state in box 14 & 15 then the box 1 amount does not need to be allocated between two states - the entire box 1 amount is understood to be the state . I think you have some labeling errors in the 1099-R form, specifically, the "verify entry" page. On the first page of 1099-R, Box 12 is about FATCA Box 13 is not there. Box 14 is State Tax Withheld (first state) Box 15 is the state and Number Box 16 is State Distribution Amount. All these labels an.My two pension 1099-R forms from Fidelity never have the distribution box filled in, even though both have NC taxes withheld. When I go thru the software though, TTX backfills box 16 with the same value as box 2a (a valid Box 2a value is defined for both forms).

For instance, on one of my 1099-R forms, my box 2a value is a couple hundred lower than box 1, due to some after-tax contributions to my traditional 401k. For my state (NC) I must use the box 2a value as the NC state distribution to be entered into box 16. My Form 1099-R 2023 Distribution from Pensions.. does not have a box 16, which is State Distribution Amt. What do I enter in this box in TurboTax? My 1099-R only has boxes 1, 2a, 2b, 4, 5, 7, 9a, 9b, 14, 15 School Employees Retirement System of Ohio. Already called SERS and they said it is a Turbo. The state number is the payer's identification number assigned by the individual state. In box 16, enter the name of the locality. . Thanks to all for weighing in on the 1099-R Box 14 New York State fiasco. . the program carries the information to your state for you. Box 12 is the state tax withheld. Box 14 is the state distribution. If box .

Please make sure that you have a regular 1099-R and not a CSA-1099-R or CSF-1099-R. To enter your retirement distribution: Login to your TurboTax Account ; Click on the Search box on the top and type “1099-R” Click on “Jump to 1099-R” On the "Who gave you a 1099-R?" screen select carefully what kind of 1099-R you have. “Box 14 on the IRS 1099-R is State Distribution, since OPERS only withholds taxes for the State of Ohio this box is not necessary. Box 12 and 13 on the OPERS 1099-R shows the state tax withholding information. . Just so I’m clear, for Box 16 in TT (state distribution amount), for reporting OPERS 1099r income, the options raised were use:

NY requires an entry in that box 16..even if it is empty on the vast majority of all 1099-R forms . 1) If box 1 and 2a are the same $$ amount..put that number in box 16 . 2) IF box 2a is somewhat lower than box 1.."I' claim you put the box 2a value into box 16 (Some people still claim it should be the box 1 value that is transferred. On my 1099-R the bank shows state distribution on line 16, which is not correct because I live outside of US since several years which they always knew. For example I had also withdrawn in 2021 and that field (line 16) was (correctly) empty in my 1099-R as I was living outside of US in 2021 too. . But if a state is listed in box 15 & the box . If you received worthless property, your employer may not file Form 1099-R. Box 2a: Taxable amount. In general, . The abbreviated name of the state and the payer’s state identification number should appear in Box 15. Box 16: State distribution. If applicable, this box contains the distribution amount subject to state taxes. Box 17: Local .Turbo Tax Home and Business 2020 is instructing the user to enter the State Distribution Amount in Box 16. However, the actual Federal Form 1099R Box gives this information in Box 14. In addition, Federal Form 1099R includes boxes 17 through 19. However, TB does not provide fields for Box 18 and 19.

Yes, leave box 6 blank, however you will need to enter the NY amount and State ID (not TIN) in the state boxes in your Form 1099-R. Also enter the distribution in box 16, if after reviewing the information it doesn't fit the criteria for tax free treatment. Depending on the type of distribution it may be considered taxable for NY. Hi. question on the form 1099-r it is asking for state distribution box 16. my 1099-r has no box 16 and what are they asking for ? But that really depends on the state. NY in particular MUST have an entry made in that box...even if exempt from NY taxes. Since retirees receive a 1099-R from each source of income, there may be multiple forms with which to contend. Nevertheless, the 1099-R is a uniform document, and each displays the 1099-R state distribution withholding. Box 16 reveals the state distribution on the 1099-R, while Box 14 indicates the state tax amount withheld.

is a 1099 r taxable

Customer: My tax form 1099 R does not have box #16 which has the same number as box #2a Your program refers to verification of the amount in #16, . Box 14 has state tax withheld but there is nothing on box 16, state distribution. Lev. Taxes, Immigration, Labor . That would not be a 1099-R..that would be a CSF or CSA-1099-R that is issued by the Federal Office of Personnel Management (OPM) _____ 1) A standard 1099-R has State "withholding" in box 14 and total state distribution in box 16. 2) A CSF- or CSA-1099-R from OPM has State "withholding" in box 12 and total state distribution in box 14.

irs 1099 r distribution codes

irs 1099 r 2023

$14.99

state distribution on 1099-r box 16|1099 r box 16 blank