life insurance distribution box changed from 7 to 4 Use Code G in box 7. If the direct rollover is made on behalf of a nonspouse designated beneficiary, also enter Code 4 in box 7. For reporting instructions for a direct rollover from a designated Roth account, see Designated Roth accounts, earlier. Buy top quality milling machines cnc products online from Chinese milling machines cnc wholesalers, suppliers, distributors, dealers & dropshippers at most competitive price.CNC mills or CNC milling machines produce parts of nearly any shape from soft metals like aluminum, harder metals like steel, and plastics such as acetal. eMachineShop .

0 · Solved: I received Form 1099

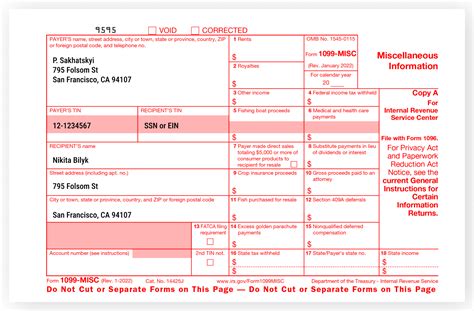

1 · My 1099

2 · Instructions for Forms 1099

3 · IRS Form 1099

4 · How to Calculate Taxable Amount on a 1099

5 · Form 1099

6 · 2024 Instructions for Forms 1099

Most cnc milling parts products boast high quality and low MOQs with direct prices from factory, covering customized cnc lathes and turned aluminum or copper parts, 316 stainless steel threaded insert cnc turning parts, and so on.

Use Code G in box 7. If the direct rollover is made on behalf of a nonspouse designated beneficiary, also enter Code 4 in box 7. For reporting instructions for a direct rollover from a designated Roth account, see Designated Roth accounts, earlier.

File Form 1099-R for each person to whom you have made a designated distribution .

How was Box 7 of your Form 1099-R coded? You should enter each Form 1099-R exactly as shown. Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross . Underneath the first drop down box for codes listed in box 7, there is a second drop box where you can add the second code. The two codes are not entered in the same .If a rollover contribution is made to a traditional or Roth IRA that is later revoked or closed, and distribution is made to the taxpayer, enter in boxes 1 and 2a of Form 1099-R the gross . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code (s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

Solved: I received Form 1099

When entering the Distribution Code in Box 7, if the Code is a 7 or G, no further action is necessary. However, if the Distribution Code is 1 a prompt will be given to Select "Form 5329 Options" which is the 10% Additional Tax .

You’ll receive an IRS Form 1099-R if you’ve received a distribution of at least from a retirement account, pension, annuity, or variety of other plans. Today’s post can be used as a reference when deciphering the code (s) . Distribution from a life insurance, annuity, or endowment contract and for reporting income from a failed life insurance contract under section 7702(g) Code 7 is used if no other .

If you surrender a life insurance policy or non-qualified annuity for its cash surrender value, the insurance company will calculate the taxable distribution for you. However, if you want to determine your taxable distribution . Your box 1 is your total amount of distribution for 2. Of that, box 2a, the only taxable amount is 4. The difference is 8, your premiums for the year. That number matches your box 5, insurance premiums. You are code 7 for a regular distribution. You are not paying taxes on the 8 premium, only on the extra 4 you received.

My 1099

REQUIRED MINIMUM EquiTrust Life Insurance Company® DISTRIBUTION FORM 7100 Westown Parkway, Suite 200 (FOR RMD USE FORM ONLY) West Des Moines, Iowa 50266-2521 (866) 598-3692 Fax: (515) 226-5101 www.EquiTrust.com Mailing Address: PO Box 14500 Des Moines, Iowa 50306-3500 1. OWNER INFORMATION – Please print Contract Number

Third-party distribution is growing. Third-party distribution has been on the rise. Between 2016 and 2022, the annual growth rate in sales for third-party distributors—which include IAs, B/Ds, and banks—was approximately .Normal distribution. Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment . The 1099 will look similarly to the example above for a non-taxable distribution. The full transfer amount will appear in box 1 with box 2a showing no taxable amount. Additionally, box 7 should use should report code 6, which is the specific code for a 1035 exchange. The code for other distributions from life insurance will normally be 7. I understand what you are saying, however that amount is not a death benefit from a life insurance policy but is an annuity that was purchased from an insurance company. It is being correctly taxed by TurboTax. Code 4 is death and Code D is Annuity payment. This is an annuity purchased from a life insurance company, not a life insurance payout.

Instructions for Forms 1099

Beneficiary Change for Life Policy - CS06893 Beneficiary Change for Life Policy. Electronic Funds Transfer (EFT) Authorization - CS06711 . Lincoln MoneyGuard ® solutions are a universal life insurance policy with a long-term care rider. The policies and riders have exclusions, limitations, and/or reductions. . Answered: Code "4" life insurance proceeds is recorded as income on 1040. Welcome back! Ask questions, get answers, and join our large community of tax professionals. . How do I record life insurance distribution from 1099 R, with a distribution code of "4"? . pricing and service options subject to change without notice. By accessing and .

In processing the 1099R for cash out of a variable Universal Life Insurance policy, TT is not prompting me for funds paid in excess of the premiums. . In Box 7, distribution codes are 7 and D ("Normal distribution" and "Annuity payments from nonqualified annuities that may be subject to tax under Section 1411"). Total distribution was ,489 .Disability. By checking this box, I certify that I am unable to engage in substantial gainful employment due to an impairment that is of a continuing or permanent nature as defined under Internal Revenue Code Section 72(m)(7). Page 1 of 4 Distribution Request Form Protective Life Insurance Company (PLICO/"the Company")

715 VP Insurance Distribution jobs available on Indeed.com. Apply to Vice President, Vice President of Operations, Director of Operations and more! . Optional insurance (life, . This is a well-paid position that rewards the right person who has the tenacity to push for change. If this career choice fits who you are, please contact .

Insurance companies generally do not issue Forms 1099-R for distributions from insurance policies unless at least some portion of the distribution is taxable. If you received a Form 1099-R and box 2b Taxable amount not determined is not marked on the form, box 2a shows the taxable amount. If the value of the insurance policy was greater than . Code 1 . Use Code 1, Early distribution, no known exception, for Traditional and SIMPLE IRAs and QRPs only if the individual is not age 59½ or older and codes 2, 3, and 4 do not apply. Use even if the individual is withdrawing the money for one of the following penalty tax exceptions: unreimbursed medical expenses that exceed 7.5 percent of adjusted gross . I received a 1099-R which includes the Gross distribution (box 1), Taxable amount (box 2a), Fed tax withheld (box 4) and State tax withheld (box 14). Turbo Tax says that life insurance proceeds are not taxable and seems to imply I do not need to enter the info into the 1099-R section of Turbo Tax. Perhaps a 1035 exchange. What is the code in box 7 of the Form 1099-R? All Forms 1099-R are entered under Retirement and Social Security -> IRA, 401(k), Pension Plan Withdrawals (1099-R). The distribution will be included on Form 1040 line 5a/b. It the distribution is nontaxable, the amount will be excluded from the taxable amount on line 5b.

The IRS considers dividends earned on a life insurance policy as a return of premium. Dividends become taxable once the total dividend earned exceeds the total net premiums paid. If the dividends earned on your policy exceeded the policy’s total net premiums paid, Box 7 on Form 1099-R will show a distribution code of 7. Normal distributions (Box 7 coded a 4 or 7) are not taxable on a PA income tax return. Distributions coded with a D (such as 7D) are annuity distributions and are taxable same as federal. Your basis is the amount you contributed to the . I have a similar situation for PA state tax. But the difference between Medicare wages (box 5) and state wages (box 16) includes employer paid short-term disability, and long-term disability insurance premiums, in addition to life insurance premiums over K. Are employer paid STD and LTD insurance benefits non-taxable for PA?American United Life Insurance Company® (AUL) or. OneAmerica Retirement Services LLC, companies of OneAmerica. 1-800-249-6269. Fax 1-317-285-1728. . Check this box to request distribution of your entire vested account balances, less any applicable tax. withholding and/or fees. Certain money types may be restricted based on the provisions of .

IRS Form 1099

EITC Address Change. Go to EITC Address Change . Please refer to box 7 on Form(s) 1099-R for the distribution code(s) that describes the condition under which the retirement or pension benefit was paid. . The exchange of life insurance : No. 7 - Normal distribution. normal distribution from a plan, distribution from a traditional IRA, if .Rethinking U.S. Life Insurance Distribution 5 Winds of Change Sales of life insurance and annuity products in the U.S. are growing at less than 2 percent annually, below the rate of GDP growth. Household penetration is now approximately 65 percent, compared to 83 percent in 1990. This decline cuts across all wealth bands. Among affluent households

1099-R Box 1: Gross Distribution; 1099-R Box 2: Gross Distribution; 1099-R Box 4: Federal Income Tax Withheld; 1099-R Box 7: Distribution Code(s) 1099-R Box 9b: Total Employee Contributions; 1099-R Form Information for Filing; The 1099-R Form; 1099-R Distribution Codes; Get Help Filing Your Complicated Taxes; 1099-R FAQ. What Happens If I .

ICICI Prudential Life Insurance Distribution Manager Salary - 4.5 Lakhs per year; Bajaj Allianz Life Insurance Distribution Manager Salary - 4.0 Lakhs per year; PNB MetLife Distribution Manager Salary - 3.6 Lakhs per year; Ageas Federal Life Insurance Distribution Manager Salary - 2.9 Lakhs per year I received a 1099-R for the dividends from my life insurance. Box 7 is 7. It is a non-qualified plan. Would I use: K2 - Non-qualified deferred compensation . Pennsylvania Distribution Type and Basis for a Life Insurance 1099-R (for dividends) . There's definitely a learning curve for each state's income tax! I've made the change and the . Distribution Code Table entries on Form 1099 on Box 7. amounts reported on Form 1099-R. Description of Codes in Box 7. . Indicates the tax-free exchange of life insurance, annuity, long-term care insurance, or endowment contracts under section 1035. . Distribution from a life insurance, annuity, or endowment contract and for reporting .

4. CHANGE PREMIUM MODE: . PROTECTIVE LIFE INSURANCE COMPANY _____ Registrar or Authorized Officer Secretary _____ . Protective Life Insurance Company P.O. Box 1928 Birmingham, AL 35201-1928 . CONTRACT/POLICY NO. OWNER NAME OWNER SS NO. DAYTIME PHONE NO. 11. TELEPHONE ACCESS AUTHORIZATION: .The False Threats about RPA as Insurance Distribution Channel 13 4. The 2025 Insurance Distribution – A Prediction 14 4.1. Digital Distribution – A New Normal 15 4.2. Deep Dive on 2025 Distribution Channels 16 . On the non-life insurance side, there are micro insurance products that will last just for few hours

How to Calculate Taxable Amount on a 1099

Form 1099

Order parts and accessories for all types of CNC machines. Cutting tools, workholders, toolholders, measurement and calibration devices, and more.

life insurance distribution box changed from 7 to 4|How to Calculate Taxable Amount on a 1099