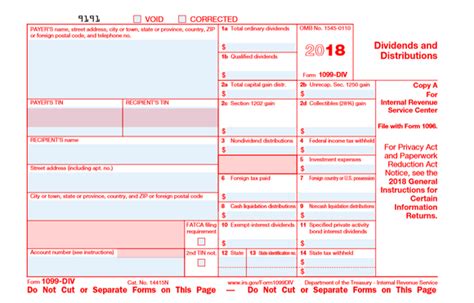

capital gain distribution box 2a 2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain distributions, you may be able to report the amounts shown in box 2a on your Form 1040 or 1040-SR rather than . Type 1 Enclosures constructed for indoor use to provide a degree of protection to personnel against access to hazardous parts and to provide a degree of protection of the equipment inside the enclosure against ingress of solid foreign objects (falling dirt).

0 · form 1099 div box 2a

1 · form 1099 div box 12

2 · capital gain distributions tax treatment

3 · box 2a 1099 div

4 · box 12 exempt interest dividends

5 · are capital gains distributions taxable

6 · 1099 div box 12 states

7 · 1099 div 2a explained

Here’s a brief overview of the most common types of ceiling electrical boxes: Octagon Boxes – These boxes are the most common type of ceiling electrical box and are used for wiring recessed lighting fixtures and other ceiling-mounted devices.

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.File with H&R Block to get your max refund. For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the . Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities . The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13.

2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain distributions, you may be able to report the amounts shown in box 2a on your Form 1040 or 1040-SR rather than .

Section 897 gain. RICs and REITs should report any section 897 gains on the sale of U.S. real property interests (USRPI) in box 2e and box 2f. For further information, see Section 897 gain, . The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser .

Box 2a: All capital gains (except for short term capital gains from mutual funds). This will include long term capital gains that will be combined on Schedule D with capital gains and. Capital gain distributions, reported in Box 2a, are payments made by mutual funds or REITs from profits earned on the sale of securities. These distributions are taxable and should be reported as long-term capital gains on .If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.File with H&R Block to get your max refund. For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are taxed at a lower rate than ordinary income.

form 1099 div box 2a

Capital gain distributions. When an investment makes a distribution of its earnings to you and reports it in box 2a of Form 1099-DIV, the IRS generally allows you to treat the distribution like a long-term capital gain. This is beneficial since the same tax rules that apply to your qualified dividends also apply to qualified capital gain . Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities in a taxable account. Eventually corporations pay . The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13.

2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain distributions, you may be able to report the amounts shown in box 2a on your Form 1040 or 1040-SR rather than Schedule D. See the Instructions for Form 1040.Section 897 gain. RICs and REITs should report any section 897 gains on the sale of U.S. real property interests (USRPI) in box 2e and box 2f. For further information, see Section 897 gain, later. Online fillable Copies 1, B, and 2. To ease statement furnishing requirements, Copies 1, B, and 2 are fillable online in a PDF format, available at . The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for . Box 2a: All capital gains (except for short term capital gains from mutual funds). This will include long term capital gains that will be combined on Schedule D with capital gains and.

Capital gain distributions, reported in Box 2a, are payments made by mutual funds or REITs from profits earned on the sale of securities. These distributions are taxable and should be reported as long-term capital gains on your tax return, regardless of .

If any part of the ordinary dividend reported in box 1a or capital gain distributions reported in box 2a is attributable to section 897 gains, report that gain in box 2e and box 2f, respectively. See section 897 for the definition of USRPI and the exceptions to the look-through rule.

File with H&R Block to get your max refund. For tax purposes, Form 1099-DIV, Box 2a reports your capital-gain distributions. You could also receive this on a similar statement from the mutual fund company. These distributions are taxed at a lower rate than ordinary income.Capital gain distributions. When an investment makes a distribution of its earnings to you and reports it in box 2a of Form 1099-DIV, the IRS generally allows you to treat the distribution like a long-term capital gain. This is beneficial since the same tax rules that apply to your qualified dividends also apply to qualified capital gain .

how to mount acti a81 camera on electrical box

Box 2a Capital Gain Distributions. Box 2a is the danger zone of the Form 1099-DIV. In a way, it is unavoidable to recognize dividends (even if such dividends are QDI) if one wants to invest in a broad based portfolio of equities in a taxable account. Eventually corporations pay . The capital gain distributions are entered in Box 2a of the 1099-DIV input screen. These amounts will flow to your Schedule D part II line 13.2b, 2c, 2d, and 2f and your only capital gains and losses are capital gain distributions, you may be able to report the amounts shown in box 2a on your Form 1040 or 1040-SR rather than Schedule D. See the Instructions for Form 1040.

how to mount a junction box in drywall

Section 897 gain. RICs and REITs should report any section 897 gains on the sale of U.S. real property interests (USRPI) in box 2e and box 2f. For further information, see Section 897 gain, later. Online fillable Copies 1, B, and 2. To ease statement furnishing requirements, Copies 1, B, and 2 are fillable online in a PDF format, available at . The next four boxes show capital gains distributions from mutual funds, REITs, collectibles, and small businesses. Box 2a shows the total capital gain distributions paid out. This is typical of mutual funds, and to a lesser degree index funds, as managers sell long-term holdings for . Box 2a: All capital gains (except for short term capital gains from mutual funds). This will include long term capital gains that will be combined on Schedule D with capital gains and.

form 1099 div box 12

capital gain distributions tax treatment

Stainless steel is an alloy of steel that contains a minimum of 10.5% chromium which leads to one of the many benefits of the material. The added chromium contributes to the corrosion resistance of stainless steel. Chromium adds a shine to the material that makes it great to use in cases where aesthetics matters.

capital gain distribution box 2a|box 12 exempt interest dividends