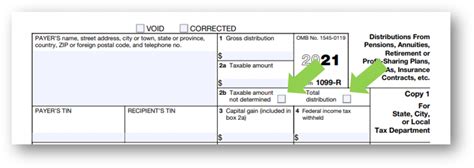

why does my box 2a say 0.00 for 401k distribution Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable. If there is no entry in this box, the payer wasn't able to determine the taxable amount .

GRP & Metal Meter Box Covers: Ideal for Quick Repairs, Universal Fit, Easy Install. Fast UK Delivery. Order Now for Best Service!

0 · box 2b not determined

1 · box 2b is not taxable

2 · box 2a on 1099 r

3 · box 2a non taxable amount

4 · box 2a blank 1099 r

5 · 1099r box 2a meaning

6 · 1099 r 0 in box 2

Junction boxes, also known as electrical outlet boxes or J boxes, act as weatherproof outdoor enclosures that provide secure housing for electrical wiring and devices. These outdoor waterproof boxes protect electrical components from external forces such as weather, neighbouring materials, and vandalism.

If you see a 0 (zero) in Box 2a of your 1099-R paper form, the entire distribution amount in Box 1 is nontaxable. However, if Box 2a is blank (empty) on your 1099-R form, the taxable portion of your distribution needs to be calculated:If you see a ”0” (zero) in Box 2a of your 1099-R paper form, the entire .

If you see a ”0” (zero) in Box 2a of your 1099-R paper form, the entire distribution amount in Box 1 is nontaxable. However, if Box 2a is blank (empty) on your 1099-R form, the . If box 2a is blank (there's nothing in there), that doesn't means the box 1 amount is nontaxable. Rather, it is up to you to determine from your records the nontaxable amount to .If you made nondeductible contributions to a Traditional IRA and are withdrawing only the contributions and not any earnings, enter Box 2a - Taxable Amount shows the portion of the distribution that is generally taxable. If there is no entry in this box, the payer wasn't able to determine the taxable amount . for box 2a. If you had a direct rollover from a .1099-R Box 2: Gross Distribution. This box is significant because it identifies the taxable amount of a distribution that’s reported by the payer. The annuity or retirement plan determines the .

box 2b not determined

A: If your 1099-R Statement Box 2.a for the Taxable Amount is marked “Unknown,” OPM did not calculate the tax-free portion of your annuity. Some of the most common reasons .

thomas the tank engine metal lunch box

Capital gain numbers for Box 3 are captured in Box 2a: Taxable Amount. If you received a lump-sum distribution from a qualified plan and meet the birth date requirements, . The instructions for preparers of Form 1099-R state "Generally, you must enter the taxable amount in box 2a. However, if you are unable to reasonably obtain the data needed to .

Box 2a says "Unknown" - but when entering data into Turbo Tax,, you cannot enter that word (or any letters) for Box 2a - you can only enter numbers - and if you leave it blank, you then come up with the conclusion and a warning note when you finish entering everything else for the form, that you meant "0" and that NONE of the distribution is . What that article is refering to is a distribution from a Traditional IRA that *does* have the same amount in box 1 and 2a AND the not determined box is checked. That is because the IRA custodian has no idea if the IRA owner has a non-deductible basis in the IRA (that could be held by a different custodian). I have been able to determine this value and entered it in box 2A. Turbo Tax, however, used the gross distribution from Box 1 to calculate the taxable income. . If it was a rollover it should say ROLLOVER by the "b" line. (1040A lines 11b & 12b) . Distribution from my 401K (rolled over into an IRA): A long time ago the General Electric .

IF box 2a is empty, or "undetermined" then it would be the Federally-taxable amount of box 1 (which is usually the same as box 1, unless after-tax contributions were made to that retirement account) ____________*Answers are correct to the best of my knowledge when posted, but should not be considered to be legal or official tax advice.* Box 1: K. Box 2a: Thank you for the quick response. My 1099-R, Box 1 states " The gross distribution is the 1099-R box 1and taxable amount is box 2a. . you are first required to attempt to get a corrected Form 1099-R if the form provided by the payer shows an amount in box 2a greater than the amount in box 1. February 3, 2020 4:46 PM. 1 3,131 Reply. Bookmark Icon. . **Say "Thanks" by clicking the thumb icon in a post.00," and Box 14 states ",700." That was the additional tax money (5/month) I like an idiot in my poor mental & emotional state voluntary gave the state of Georgia because I did not know my military retirement was tax-free.. Box 5: K. Box 7: G (direct rollover of a distribution to a qualified plan. or an IRA) IRA/SEP/SIMPLE : blank . 2) from my brokerage for the Roth conversion: Box 1: K. Box 2a: K. Box 7: 7. IRA/SEP/SIMPLE (x) I followed dmertz’s answer above and split my employer’s 1099-R into 2 for the 2 amounts in . Hello All: This is my first post in this forum. I have a client who told me he took some money from his retirement. He gave me his 1099-R, it has amount in line 2a but box 7 Distribution Code is G. He told me he received money from his retirement plan but the 1099-R box 7 code G indicates that it is rollover and nontaxable. Your Form 1099-R is correct as received. A Form 1099-R for a regular distribution from a traditional IRA is required to have the same amount in box 2a as box 1 and box 2b Taxable amount not determined marked. This is because all of your IRA accounts, possibly at different custodians, are treated as one large account for determining the taxability of any distribution .

A couple clarifications though. There was no figure in box 5 but I had the cost basis from my 401k distribution summary so I put that in Box 5 and subtracted that value from the Box 1 gross to create the Box 2 taxable entry. The IRA box was checked, which seemed erroneous since this was a 401k distribution, so I removed that check mark. The funds were rolled over from one company (Co#1) to another company (Co#2). I entered the 1099-R as printed into TurboTax Home & Business, but neither Federal or State taxes owed increased. But my understanding is that the total amount of the distribution should be taxable. Both Co#1 and Co#2 say everything was handled and reported correctly. That's not what I get. It asks if the numbers in box 1 and box 2a are correct. If I say no, a note pops up and says: "Review the numbers below and make any necessary changes.: box 1 Gross distribution. box 2 taxable amount. 0.00. There is no way to ask for a different amount.

If that number is zero, then you do not need to report the form. However, even though there is no taxable distribution, you are required to report the distribution. For instance, if the box 7 code is a G, showing a rollover, this is not taxable, but it is reportable. The same is .The "state distribution" is the amount of the 1099-R distribution that is reported to a state (or states) as income; that state could be the one you live in or it could be the state where you worked and "earned" the distribution (e.g. pension). Depending on the type of distribution and your state of residence, a state distribution may or may not be taxable income to the state where it is .

Found this thread helpful. Trying to help my Grandma with taxes, her 2a Taxable amount is unknown and 9b is unknown as well. I have found a previous 1099 when my Grandpa was alive, and see the 9b amount from that. The question I . The entry in box 9(a) is supposed to show your percentage of the distribution entered in box 1. If you did not share the distribution with anyone, you should leave the entry blank. Otherwise, you would enter the percentage of the distribution that you received. It says this Code W is a non-taxable distribution from a long term care policy. Box 8 is 1.00 and TurboTax says I owe .00 for this 1099-R. That is 10%. . He is reporting the document on his tax return just to account for the document, even though box 2a is Retirement: My box 2a is zero on my 1099-R as it is non taxable, but TT won't let me file as SmartCheck is saying it can't be zero. . Box2b it says "Taxable amount not determined" and "Total distribution", there's no boxes though so I'm assuming that means I must check the boxes in TT. Line 7 is code "1" and then it says IRA/SEP/SIMPLE, but ..00 which, in my opinion is a way to ensure it is accounted for with the IRS. I did a direct in plan conversion on my 401k plan from pre-tax to Roth sub account. (IRR). This is a taxable event. My 1099-R says the amount in box 1 and the same amount in box 2a as a taxable amount. This is correct. This year, in box 7 the only code is G which is the code for a direct rollover.

What do you do if your Tax Yr 2021 1099-R is reporting a transfer (distribution) from an employer 401(k) "after tax" contributions (Fidelity) to a Roth IRA (not a Roth 401K) and box 7 Distribution code is "G". The form is showing Taxable Income (Box 2a) which is fairly small compared to the gross distribution in box 1, and I was told this was . I received a 1099-R from a 401k early withdrawal (I'm 33 years old). I was going to roll over into an IRA but didn't. My 1099-R box 2a says "0.00" US En . United States (English) United States (Spanish) Canada (English) Canada (French) TURBOTAX; Expert does your taxes. Back. Expert does your taxes. An expert does your return, start to finish .

"FORM 1099-R, BOX 2a: TAXABLE AMOUNT. Generally, the amount shown in box 2a is the amount of the distribution that is taxable. However, if the payer is unable to reasonably obtain the data necessary to compute the taxable amount, this box may be blank and the "Taxable amount not determined" box in box 2b will be checked.Hi, thank you for your help. Box 1 has gross amount. 2a, 2b and total distribution are blank, box 3 blank. box 4 has the 10% I paid when I took the money out, the letter said sorry they died, sign this form, do you want takes taken out. So box 4 and box . If you are making a distribution from a designated Roth account, enter the gross distribution in box 1, the taxable portion of the distribution in box 2a, the basis included in the distributed amount in box 5, any amount allocable to an IRR made within the previous 5 years (unless an exception to section 72(t) applies) in box 10, and the first . We cannot make changes to Box 2a of the 1099-R. It is the customer’s responsibility to determine the appropriate taxable portion when filing their tax return by completing the Form 8606. The taxable amount in Box 2a on the 1099-R is frequently incorrect for Traditional IRA and Roth IRA distributions. This can happen at many investment firms.

1099-R’s come in two versions.. In the first version both box 1 and box 2a contain #’s.This means that the plan custodian had the information to determine the taxable amount and did so. Enter both #’s, (even if they are the same), and TT will put the amounts on either Lines 12a & b of the 1040A or Lines 16a & b of the 1040.. In the second version, box 2a is blank and, IF . Solved: If the taxable amount in box 2a says "unknown" on csa 1099r, do i put zero US En United States (English) United States (Spanish) Canada (English) Canada (French)

Outdoor Electrical Box, Waterproof Electrical Junction Box IP65 ABS Plastic Enclosure with Fan & Thermostat, Mounting Plate and Hinged Lid (15.7" H x 11" L x 5.9" W)

why does my box 2a say 0.00 for 401k distribution|box 2a non taxable amount