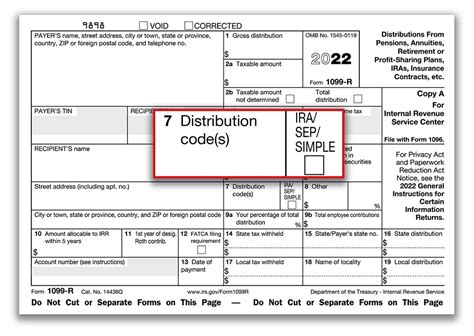

1099 box 7 distribution codes Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to . Get the best deals on Cannon Circular Connectors Connectors when you shop the largest online selection at eBay.com. Free shipping on many items | Browse your favorite brands | affordable .

0 · irs distribution code 7 meaning

1 · irs 1099 box 7 codes

2 · form 1099 box 7 codes

3 · distribution code 7 normal

4 · 1099 r distribution code meanings

5 · 1099 r distribution code 7m

6 · 1099 form distribution code 7

7 · 1099 box 7 code 1

$21.99

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.Learn how to report distributions from pensions, annuities, retirement plans, IRAs, insurance contracts, etc. on Forms 1099-R and 5498. Find out the latest developments, e-filing options, .

Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, . 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R .

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned .

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .

The following chart provides the distribution codes for Box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. If more than two .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

how to bend sheet metal without a press

irs distribution code 7 meaning

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo. 1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

The following chart provides the distribution codes for Box 7 for defined contribution plan distributions, of which two codes are typically used for each distribution. If more than two codes apply, two 1099-Rs may be required.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.For distributions made after December 31, 2023, an emergency personal expense distribution may be made from a 403(b) plan and is not subject to the 10% additional tax on early distributions.Use Code H in box 7. For all other distributions from a designated Roth account, use Code B in box 7, unless Code E applies. If the direct rollover is from one designated Roth account to another designated Roth account, also enter Code G in box 7.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401 (k), or section 403 (b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for repo.

1099-R Form Retirement Distribution Codes. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498. Instructions on how to enter Form 1099-R on your tax return

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).The following are the instructions for the 1099-R, Box 7 data entry and what each code means. that are not from an IRA, SEP, or SIMPLE are reported on Form 1040, line 1h, Other Earned Income. if filing Form 4972 - Lump-Sum Distribution. box. report amounts in Box 3, Capital gain on Form 8949 as "Form 1099-R Charitable Gift Annuity." box.

irs 1099 box 7 codes

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

how to build a metal box stand

Check out our vintage shelf brackets selection for the very best in unique or custom, handmade pieces from our shelving brackets shops.

1099 box 7 distribution codes|1099 form distribution code 7