1099-sa box 3 distribution code 1 If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see . It has a remote driver box, so what I'm doing is mounting the box *inside* the structure, and running the (low voltage) wire to the the light through the soffit. It's rated for wet locations, so no concerns were there ever to be a leak.

0 · is 1099 sa taxable income

1 · is 1099 sa considered income

2 · 1099 sa where to find

3 · 1099 sa where to enter

4 · 1099 sa qualified medical expenses

5 · 1099 sa payer name

6 · 1099 sa gross distribution mean

7 · 1099 sa federal id number

Electrical - AC & DC - Outside light mounted without a junction box - I wanted to replace the outside light that is mounted on the wall next to our front door. I bought a new one with a motion sensor, and took the old one down. I noticed there is no junction box. How serious is this? The ungrounded cable(hot and

If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see . If your 1099-SA funds are reported as a normal distribution with Code 1 in Box 3, and if you have no excess contributions to withdraw, then selecting one of the options from what you shared in your question would not .

Provided you only use the funds to pay qualified medical expenses, box 3 should show the distribution code No. 1, which indicates normal tax-free distributions. Earnings from investments in HSAs and MSAs are never . If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical . To enter amounts reported on the 1099-SA: Go to Screen 32.1, Health Savings Accounts (8889). Scroll down to the Distributions section. Enter the amount from box 1 in Total .

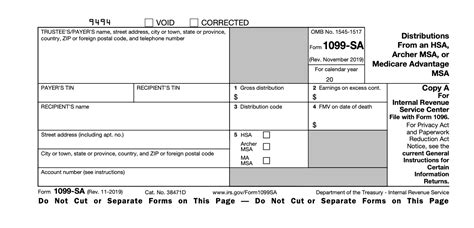

Form 1099-SA form is sent to individual taxpayers who receive distributions from health savings, medical savings, and Medicare Advantage accounts. Information from Form 1099-SA is reported on. Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair .a Form 1099-SA in the year you learned of the death of the account holder. Enter in: • Box 1, the gross distribution; • Box 3, one of the following codes (see Box 3. Distribution Code, later): .Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct .

Box 3, one of the following codes (see Box 3. Distribution Code, later): 1—If the beneficiary is the spouse, 4—If the beneficiary is the estate, or 6—If the beneficiary is not the spouse or estate; and • Box 4, the FMV of the account on the date of death, reduced by .If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.

If your 1099-SA funds are reported as a normal distribution with Code 1 in Box 3, and if you have no excess contributions to withdraw, then selecting one of the options from what you shared in your question would not be correct. Provided you only use the funds to pay qualified medical expenses, box 3 should show the distribution code No. 1, which indicates normal tax-free distributions. Earnings from investments in HSAs and MSAs are never taxed as long as withdrawals are spent on qualifying health expenses. If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical expenses as income on your tax return.

To enter amounts reported on the 1099-SA: Go to Screen 32.1, Health Savings Accounts (8889). Scroll down to the Distributions section. Enter the amount from box 1 in Total HSA distributions received (1099-SA, Box 1). Form 1099-SA form is sent to individual taxpayers who receive distributions from health savings, medical savings, and Medicare Advantage accounts. Information from Form 1099-SA is reported on.

Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair market value of .a Form 1099-SA in the year you learned of the death of the account holder. Enter in: • Box 1, the gross distribution; • Box 3, one of the following codes (see Box 3. Distribution Code, later): 1—If the beneficiary is the spouse, 4—If the beneficiary is the estate, or 6—If the beneficiary is not the spouse or estate; • Box 4, the FMV .Complete form 5329 to report the excess contributions. Box 3: Distribution Code: Not Supported in program. Use this code for normal distributions to the account holder and any direct payments to a medical service provider. Use this code if no other code applies. Use this code for payments to a decedent's estate in the year of death.

is 1099 sa taxable income

Box 3, one of the following codes (see Box 3. Distribution Code, later): 1—If the beneficiary is the spouse, 4—If the beneficiary is the estate, or 6—If the beneficiary is not the spouse or estate; and • Box 4, the FMV of the account on the date of death, reduced by .If you learn of the account holder's death and make a distribution to the beneficiary in the year of death, issue a Form 1099-SA and enter in: Box 1, the gross distribution; Box 3, code 4 (see Box 3.

using a metal brake to make a box

If your 1099-SA funds are reported as a normal distribution with Code 1 in Box 3, and if you have no excess contributions to withdraw, then selecting one of the options from what you shared in your question would not be correct. Provided you only use the funds to pay qualified medical expenses, box 3 should show the distribution code No. 1, which indicates normal tax-free distributions. Earnings from investments in HSAs and MSAs are never taxed as long as withdrawals are spent on qualifying health expenses.

If you get distribution code 5 in box 3 of a 1099-SA, it means you did not use all distributions from your account for qualified medical expenses. You must report at least the amount of the distribution not used for medical expenses as income on your tax return. To enter amounts reported on the 1099-SA: Go to Screen 32.1, Health Savings Accounts (8889). Scroll down to the Distributions section. Enter the amount from box 1 in Total HSA distributions received (1099-SA, Box 1). Form 1099-SA form is sent to individual taxpayers who receive distributions from health savings, medical savings, and Medicare Advantage accounts. Information from Form 1099-SA is reported on. Form 1099-SA has a section in Box 3 that labels the type of distribution being reported. See the next section called “Box 3 Distribution Codes” to understand the codes found here. If the account holder has died, the fair market value of .

a Form 1099-SA in the year you learned of the death of the account holder. Enter in: • Box 1, the gross distribution; • Box 3, one of the following codes (see Box 3. Distribution Code, later): 1—If the beneficiary is the spouse, 4—If the beneficiary is the estate, or 6—If the beneficiary is not the spouse or estate; • Box 4, the FMV .

is 1099 sa considered income

1099 sa where to find

In summary, we reported the facile large-area fabrication of ultrathin NUS-8 membranes with variable thicknesses and preferential orientation simply via doctor-blading attributed to the excellent solution processability of ultrathin NUS-8 nanosheets.

1099-sa box 3 distribution code 1|1099 sa where to enter